What is Customs Agents

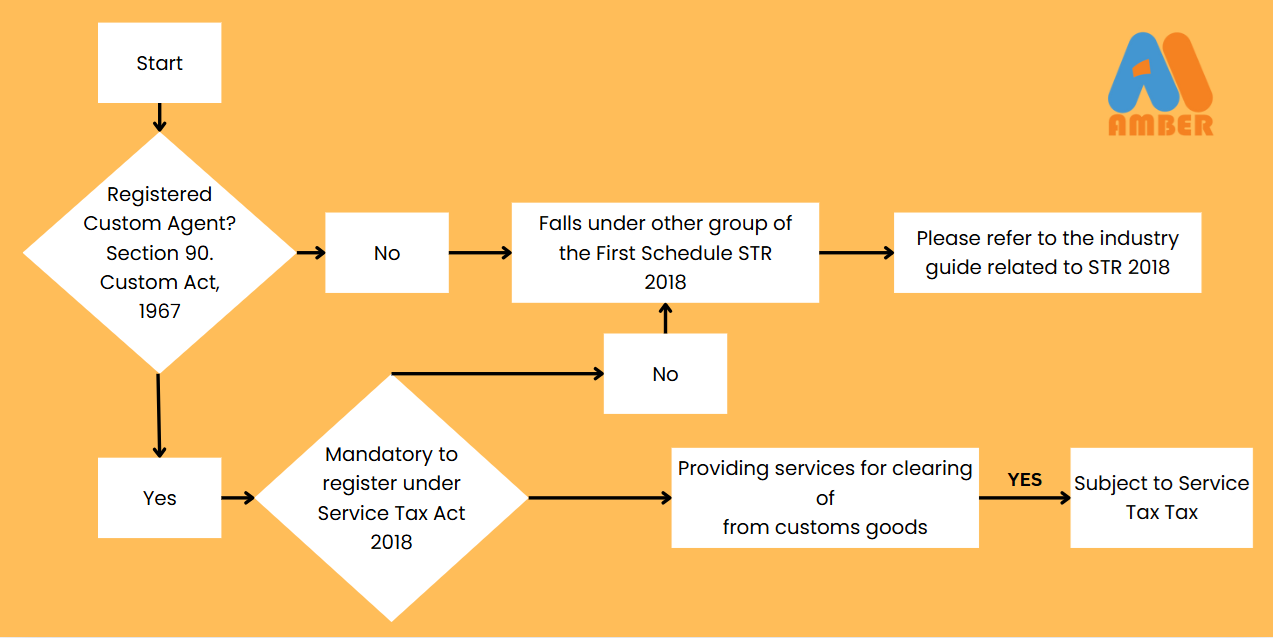

Under Section 90 of the Customs Act 1967, Customs Agents may act on behalf of Importers and Exporters to carry out business and relieve goods from Customs Control. Customs Agents consist of shipping agents, forwarding agents, and freight forwarders.

Prescribed services under service tax for a customs agent is the provision of services for clearing of goods from customs control. Meanwhile, the services of shipping agents and freight forwarders are not subject to service tax because these services are under the category of logistics management service. 9.

There is no threshold for registration under service tax. By Section 90(2), Customs Act 1967, the applicant needs to be a registered person under the Service Tax Act 2018. Customs agents who have been registered under section 90(2) of the Customs Act 1967 must apply for service tax registration within 14 days from the date of such approval as a customs agent.

CHARGING SERVICE TAX

The rate of service tax shall be charged at the rate of 6%. In the case of provision for clearing of goods from customs control by customs agent which is a prescribed service, the value of the taxable service for the charges of service tax is the actual price of services charge to his clients.

SERVICE TAX TREATMENT FOR CUSTOMS AGENT SERVICES

For service tax purposes, only the provision of services for clearing of goods from customs control will be subjected to service tax. Services for clearing of goods include:

- Preparing or amending customs declaration;

- Presenting goods for customs declaration;

- Documentation;

- Handling / forwarding;

- Examination / attendance to examination;

- Sealing;

- Electronic Data Interchange (EDI);

- Overtime (relating to clearance of goods only).

This includes any charges charged by the customs agent which is stated in the invoice issued to his client in performing the services.

Customs Agent Other Services:

A customs agent may also supply the following services to his customer which are not considered as taxable services under customs agent (but may be considered as taxable services under management services, or consultancy services): Apart from the service of clearing goods from customs control, there are also customs agents providing the following services which may be subject to service tax under other groups of taxable services. Among them are as follows:

- Recommendation and advice at all costs to provide an alternative that is more profitable and efficient. This includes recommendations and advice on freight costs, port and customs expenses, special documentation costs, insurance costs, and freight management costs. These services fall under consultancy services; All rights reserved © 2022 Royal Malaysian Customs Department. 5 Guide on Customs Agent Services As of 9 August 2022

- Advice on the most suitable mode of freight transport and the procedures of packaging, stowage, and loading of the freight. These services fall under consultancy services.

Note: The list is not exhaustive.

If a customs agent provides services that are subject to service tax under other groups of taxable services, the customs agent is liable to be registered under whichever group of the First Schedule, Service Tax Regulation 2018.

RESPONSIBILITY OF REGISTERED PERSON

A person who provides taxable services exceeding a specified threshold is required to be registered under the Services Tax Act 2018 and is known as a “registered person” who is required to charge service tax on his taxable services made to his customers.

A service provider reaching the prescribed threshold of taxable services is required to be registered. For further guidance and details on registration, including an autoregistration exercise, please refer to the Service Tax Registration Guide.

A registered person is responsible for:

- Charge service tax on taxable services;

- Issue an invoice and receipt to the customers in respect of any transaction relating to the provision of taxable services;

- Submit service tax return through SST-02 Form electronically and pay service tax before due date;

- Keep proper records.